Building Wealth, Reducing Taxes: The Game Most People Don’t Even Know They’re Losing

Discover how to develop a winning tax planning strategy to support your wealth-building goals as a business owner or investor. Learn key strategies to minimize taxes and maximize wealth.

Disclaimer: My goal in these articles is to simplify the complex and help you take the next step in your financial situation. As such, this is not a comprehensive deep dive into every possible nuance or strategy. This article, like all my resources, is intended solely for educational purposes and should not substitute for specific investment, financial, or tax advice. Always consult a qualified tax professional for guidance about your tax situation.

💡 Key Takeaways - Tl;dr:

Discover how business owners and employees face vastly different tax realities based on gross income vs net income.

Ready to make a strategic move in your wealth-building game? Transitioning from employee or self-employed to a business owner and an investor is essential - that’s where you’ll find winning wealth and tax strategies.

4 Questions to position for maximum tax savings:

Where are you starting with your wealth?

Where do you want to go?

How flexible is your growth strategy?

What’s the big picture for your wealth and tax strategy?

Explore 5 Fundamental Strategies to Reduce Taxes: Elimination, Deductions, Conversion, Brackets, and Deferrals

If you would like the video/podcast version of this article to watch or listen rather than read, please check out the video below:

This article is the third in our Tax Planning Series, designed for the frustrated Business Owner or Investor who needs to develop innovative and effective Tax Planning Strategies to support their Wealth-Building Goals.

It’s for those who are frustrated with the amount of tax they owe and want to figure out the rules of the tax game and develop a winning strategy.

It is for those who are seeking to build their wealth and grow a business, but hate being set back by the big IRS check that goes out the door every year.

In this article, I’m going to help you understand:

Where to start with your Tax Planning Strategy

How to Evaluate your Current Tax Position

How to Position Your Income and Wealth for Maximum Tax Savings

How to Apply Tax Strategies to Key Areas

Decoding Tax Planning Strategy

“Next to being shot at and missed,

nothing is really quite as satisfying as an income tax refund.”

- F.J. Raymond

When I dive into tax planning with people, I ask whether they have done tax planning before. Often the most they’ve done is get help with their estimated tax payments or putting an S Corporation together. Very few have actually moved the needle on significantly reducing their tax liability.

Many people come to me knowing that they want to reduce their tax liability but they don’t know where to start. They have wealth-building goals, but they don’t know the strategies or implications of their financial decisions on their tax liability.

To their credit, the tax law is complicated, and the IRS codes are endlessly complex, with new tax laws coming out every year. With all this complexity, how should you approach building your tax planning strategy?

Here are the three simple steps you should take in building a robust tax planning strategy:

Understand where you are in relation to the government’s goals

Position Yourself for Maximum Tax Savings

Apply specific tax strategies in areas of alignment

The second step is the focus of this article. The third is in the following articles, and the first was in the previous article.

What is Your Current Tax Position?

As a recap of the prior article, What The Government Wants with Taxes (and How to Unlock Tax Savings), let’s review the government’s goals below.

Governments Goals

If you haven’t checked it out yet, give it a read. You should ask yourself:

1. What are my goals for wealth creation?

Remember that we aren’t focused on tax savings to spite the government - we want tax savings to increase your wealth.

2. What investment options that the government incentivizes will help me reach those goals?

The best tax planning investments are Business, Research & Development, Real Estate, Energy, Agriculture, Insurance, and Retirement & Estate.

3. What of those investment options will produce the greatest wealth with the least amount of taxes?

This is the question this article and the rest in this series will uncover.

Positioning Yourself for Maximum Tax Savings

The best way to understand how to maximize your tax savings is to get into a position that allows you to both align with the government’s goals and incentives and your own personal goals for wealth creation.

The simplest model I’ve found for understanding how to position yourself is from Robert Kiyosaki.

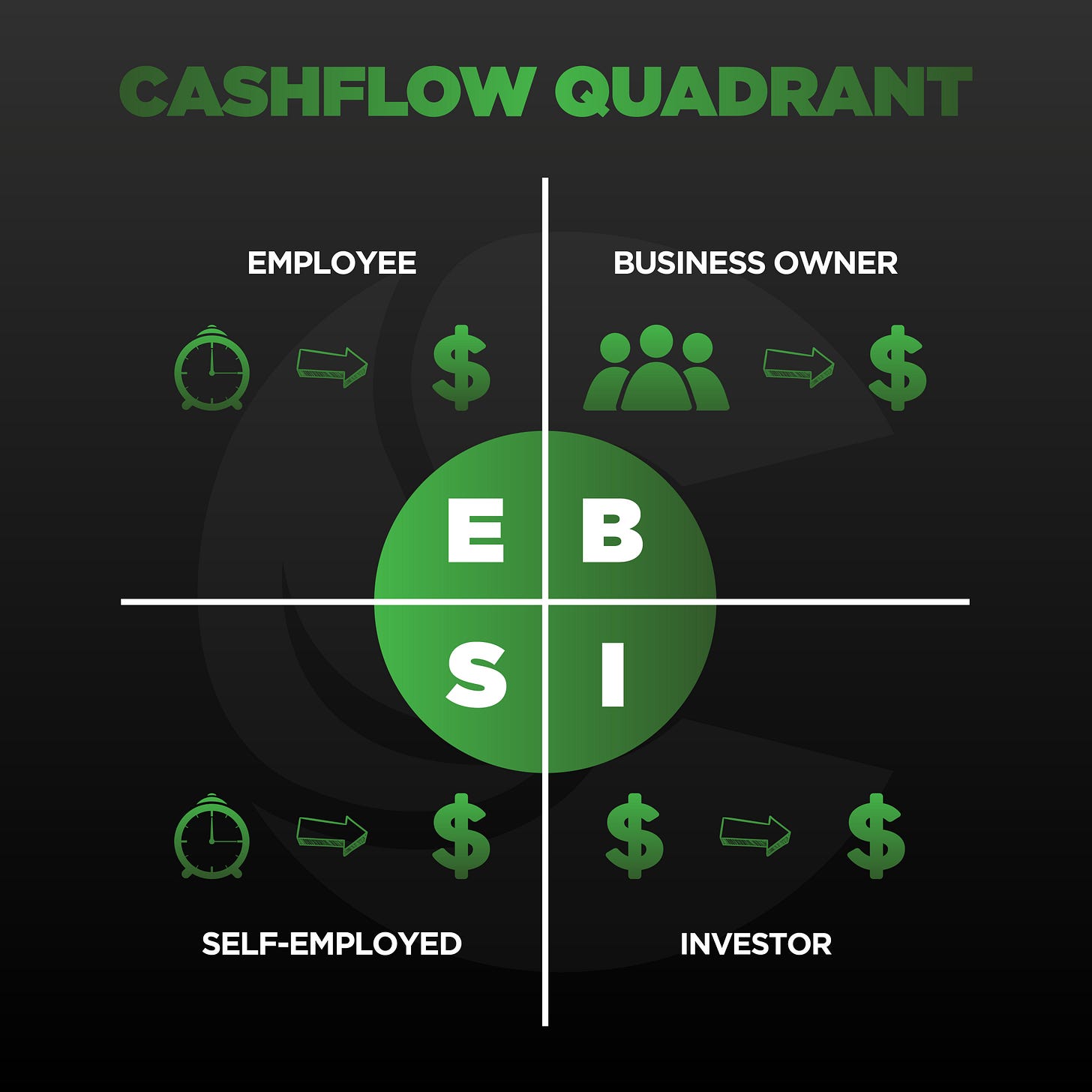

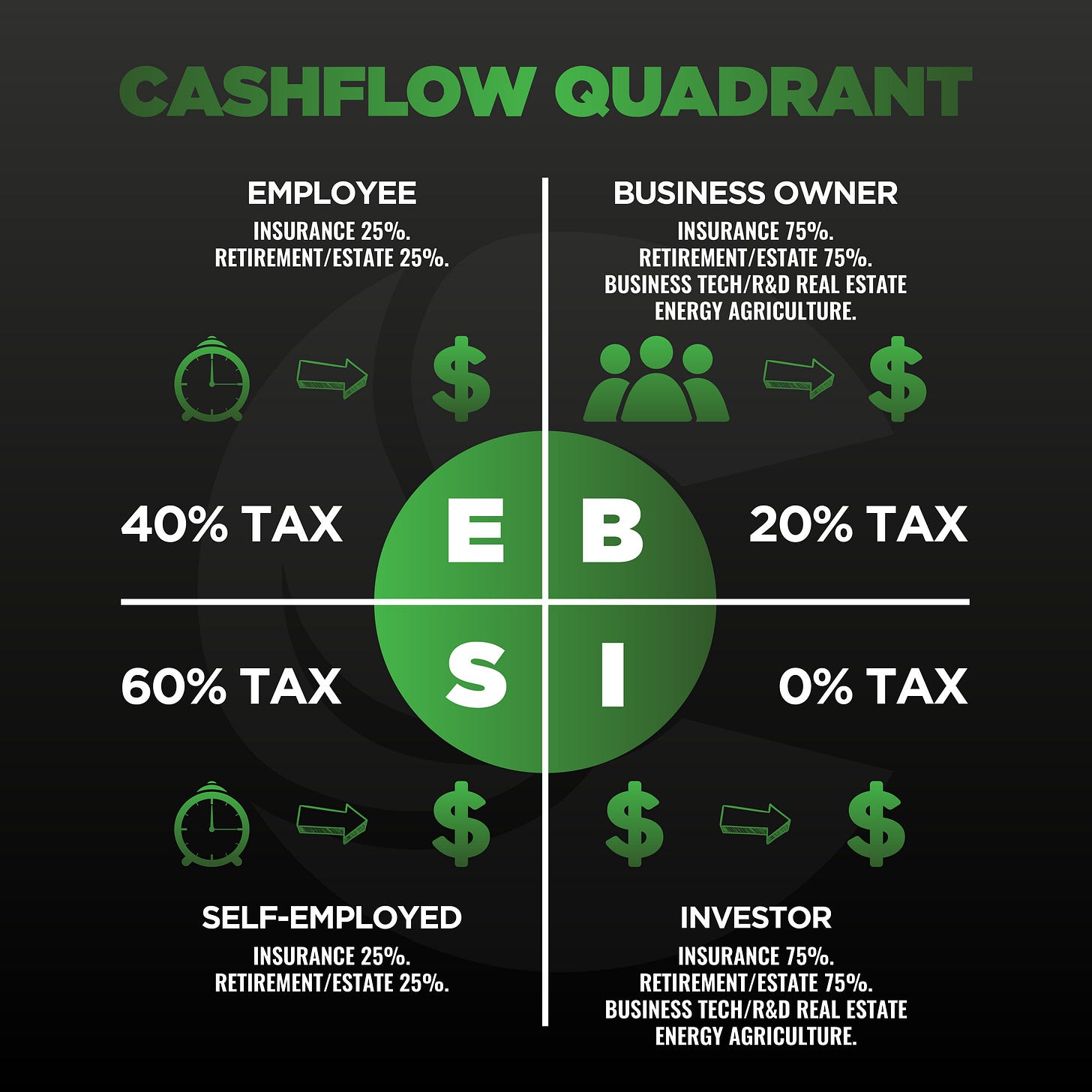

In Robert Kiyosaki’s book Cash Flow Quadrant, Kiyosaki builds on his framework in Rich Dad, Poor Dad by providing a way of thinking about the world between those who trade time for money through paychecks from others (Employees and Self-employed on the left side) and those who receive money from businesses and investments (right side).

You can read more about the fundamentals of Kiyosaki’s Cash Flow Quadrant as it applies to business here: https://www.richdad.com/cashflow-quadrant-fundamentals

Cash Flow Quadrant and Your Taxes

The Cash Flow Quadrant is a simply yet powerful illustration of how different income and investments are taxed differently.

Here’s a curated video I put together with Robert Kiyosaki and Tom Wheelwright explaining the Cashflow Quadrant and Taxes:

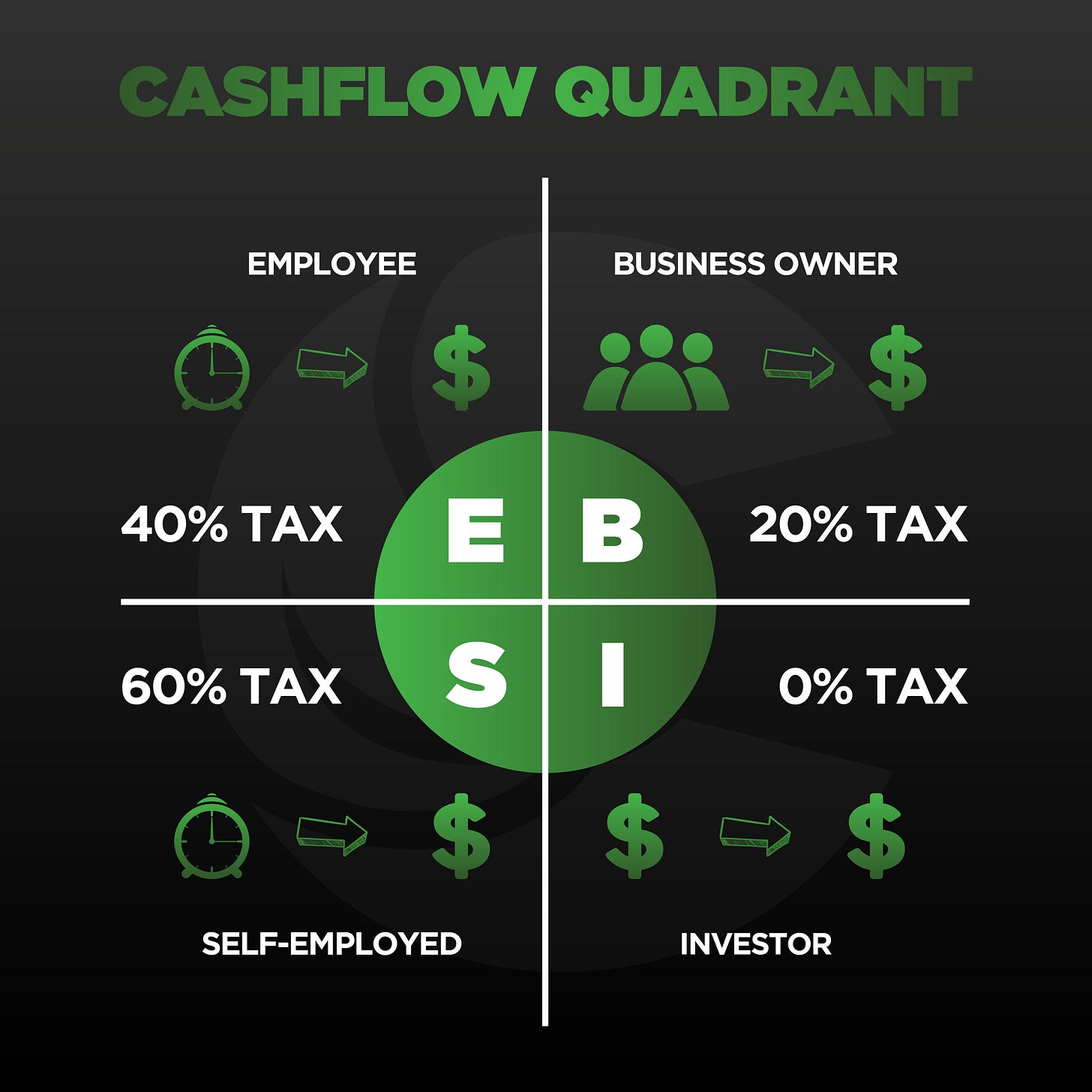

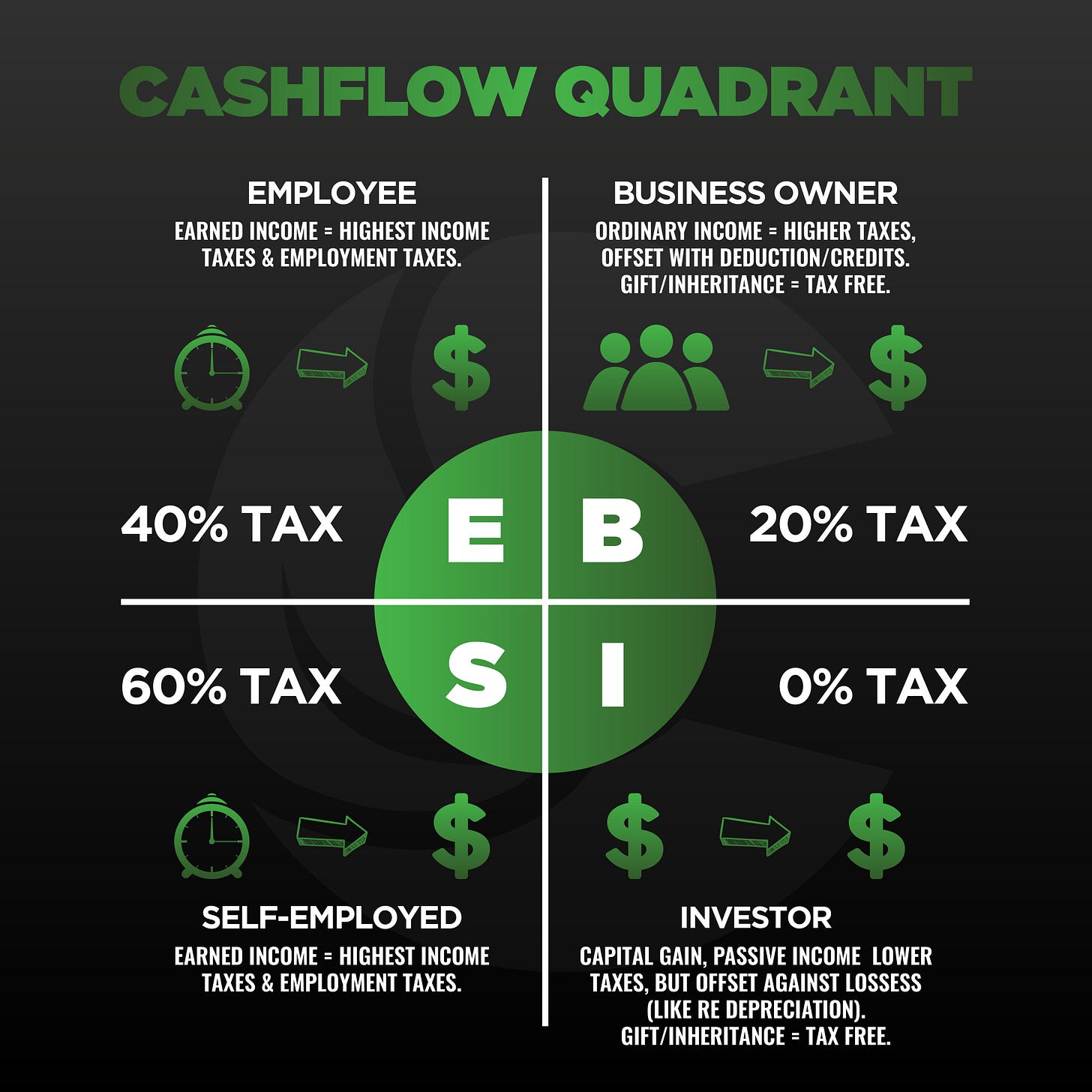

The Cash Flow Quadrant is an excellent basic framework for understanding income and wealth generation at a fundamental level, but it also has a significant impact on how you are positioned for tax savings. Tom Wheelwright showed that you can also include rough tax rates for each of these quadrants as follows:

Do you see?

Left Side - Employee/Self Employed: You work, get paid, and get taxed. A lot.

Right Side - Business/Investor: You invest, you earn, you get taxed, but significantly less with many more legal loopholes.

On its face that sounds really unfair, and I’m not going to tell you it isn’t. But tax law has evolved just like water running down hill - it is going to take the path of least resistance to its goals.

Business owners and Investors put up a fight and try to find ways to avoid taxes, while Employees and Self-Employed don’t even show up for the game.

On the one hand, the government has simply had an easier time taxing earned income from employees because they haven’t made a fuss about it. On the other hand, business owners and investors have helped the government get what it wants.

Understand that this discrepancy is a feature, not a mistake, of a tax system that is designed to incentivize certain behaviors

Here’s how the tax game plays out:

Every good Business Owner and Investor views taxes as a wealth drain and an expense that they actively position themselves to avoid to preserve their bottom line profits and wealth.

Most employees and self-employed look at taxes as something they are destined to pay and can’t get out of. Just look at the way a W2 is set up. Do you get a choice to take your whole paycheck? No. It is taken out before you even get paid. In fact, most employees go right along and even increase their withholdings and estimated tax payments and celebrate the refund when they withhold more than they owe! They are relieved that the extraction process is over and try to ignore how much of their hard-earned money just went out the window.

Different Income Types = Different Taxes

While everyone operates under the same tax code, the amount of tax you pay will vary widely based on the kind of income you receive. I’ve included the types of income found in each quadrant below to help you see the differences.

Earned Income is always charged the highest tax rates and combines ordinary income tax with employment taxes against the gross income earned

Ordinary Income from businesses is charged high ordinary income tax rates, but this is on the net income earned, not the gross.

Investment income is charged the lower capital gains and passive income rates, but this is also reduced by passive losses and paper (not cash) expenses like depreciation and depletion

Gifts and Inheritances are mostly structured for no income tax burden at all, and while the lower and middle class do get some benefit, this benefit is primarily enjoyed by the wealthiest classes.

It isn’t that there is a different tax code for business owners and investors and another for employees and self-employed, but rather the kinds of activities are taxed differently regardless of who is being taxed.

W2 Employees and Self-Employed individuals have earned income, which is taxed at the highest federal and state tax rates as well as payroll taxes and self-employment taxes for Social Security and Medicare. But this isn’t actually the biggest difference between the left and the right side.

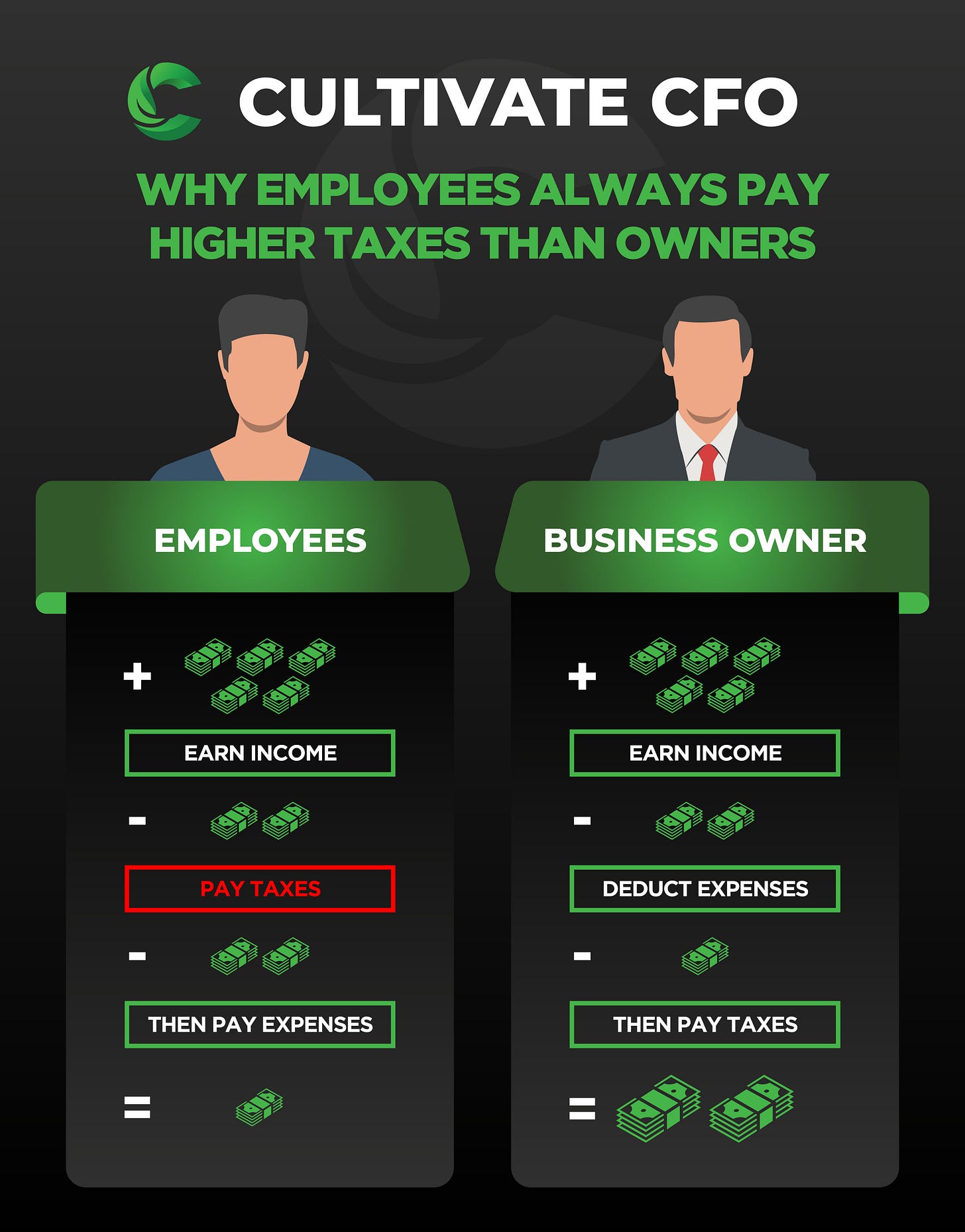

Biggest Tax Difference: Gross or Net Income

The most critical distinction in tax planning is understanding gross and net income.

Business owners pay ordinary income tax rates like employees, but not before being able to take deductions to reduce their net taxable income.

Investors are typically taxed at lower rates through most of their income coming from capital gains and passive income, which are all after-expense figures. However, they also get to offset against other expenses and losses as well as asset depreciation like in real estate and oil and gas investments.

The real difference is what you're taxed on - gross or net income. It's a game-changer.

Here is the order of events for Employees vs. Business Owners that shows why Employees will always be taxed higher than Business Owners.

Here’s the key: if an employee and a business owner make the exact same top line income, the business owner will always pay less in taxes.

Here’s a video I put together explaining these differences in greater detail:

Key Distinction between Self-Employed and Business Owner:

You may be someone who falls into the Self-Employed category. You might be asking yourself whether you are Self-Employed or a Business Owner?

Here is a key strategy we use to make this distinction and move you from Self-Employed to Business Owner:

Schedule C or S Corporation?

If you are still filing your business as a Schedule C, you are predominantly in the Self-Employed category.

If you have an S Corporation, you have taken the first step to being a Business Owner.What’s the difference?

S Corporation owners are able to pay themselves a Reasonable Salary for their earned income (left side of the quadrant) and take their dividends as owners (right side of the quadrant). This enables them to reduce Self-Employment taxes on the value the business is bringing them beyond their invested efforts.

There are rules to follow which I have detailed in another article, but this is an excellent, straightforward strategy that will deliver you ongoing savings for years to come.

Incentives Given to Employees vs Business Owners and Investors

The Government is always going to provide Business Owners and Investors with the best deals because they are the ones with the ability to give the Government what it wants: economic growth and stability, social welfare, and national security.

This next chart shows where the majority of the partnerships and related tax savings occur between the government and its citizens:

Ultimately, what this chart shows is those who are passive and those who are active participants in this game of tax.

You can either partner with the government and engage in the strategic positioning of your assets and wealth, or you can draw back and let the game be played at your expense.

When we add to these quadrants the amount of tax planning strategies and savings options available to each quadrant, the differences become glaringly obvious.

If you want to build wealth and save taxes, you must play the game as a business owner and an investor.

Paid Subscribers will get the following below:

Apply Tax Strategies to Key Areas of Alignment

4 Questions to Maximum Tax Savings

5 Ways to Eliminate or Reduce Income Taxes

Cultivate CFO is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Questions or further thoughts? Feel free to drop them in the comments and we can dive deeper!