What The Government Wants with Your Taxes (and How to Unlock Tax Savings)

Unlock strategic tax planning insights for wealth-building. Learn government goals, active partnership tactics, and 7 key areas for tax savings.

Disclaimer: My goal in these articles is to simplify the complex and help you take the next step in your financial situation. As such, this is not a comprehensive deep dive into every possible nuance or strategy. This article, like all my resources, is intended solely for educational purposes and should not substitute for specific investment, financial, or tax advice. Always consult a qualified tax professional for guidance about your tax situation.

💡 Key Takeaways - Tl;dr:

Understand the Government’s Goals: Tax savings come with understanding the objectives behind the laws and bringing investments into alignment.

Politician’s Greatest Power: the ability to Tax the Population.

Main Goals of the Government: Economic Growth and Stability, Promoting Social Welfare, and National Security.

Become an Active Partner with the Government through: Business, Research & Development, Real Estate, Energy, Agriculture, Insurance, and Retirement & Estate

Imagine with me a world where every April 15th doesn’t come with resigning to the inevitable loss as your tax payment drains your hard-earned cash, but instead, with the anticipation of a chess grandmaster confidently setting up the winning move.

This article, the second in our Tax Planning Series, isn't merely a discussion on tax planning strategies; it's an invitation to a new way of thinking about taxes. This series seeks to educate Business Owners and Investors on how to develop an effective Tax Planning Strategy to support their Wealth-Building Goals.

The following is for those who are seeking to build their wealth and grow a business, but hate being set back by the big IRS check that goes out the door every year.

Approaching tax planning is like playing chess. Each move you make, whether it's a strategic investment or a well-timed deduction, is like moving your pieces into position to protect your king and take ground. Learning effective strategies and anticipating your opponents moves takes time, but will lead to you consistently winning the game.

This article is for those who have been trying to figure out the rules of the tax game and how to develop a consistent winning strategy.

In this article, I’m going to help you understand:

The Government’s Goals with Tax Law

How the Government wants to Partner with Business Owners and Investors like you to accomplish their goals

7 areas of strategic alignment you can leverage for tax savings

My Journey into Tax Planning

When I first found myself immersed in tax return preparation as a young tax accountant, I would have clients coming to me after I had prepared their tax returns, asking me what they could to lower their tax liability. I had been excited about how I had polished off all my hard work on their tax returns and was feeling quite good about my work, but they didn’t seem to care about their nice neat and technically correct tax returns - they expected that.

👉🏻 All they were focused on was the big tax liability check they had to write - and rightly so!

The problem was, I didn’t have any answers for their questions that really made a big dent in their liability, nor did I find any answers in the materials from all the college courses I had taken or the tax preparation books and guides I had on my shelf.

But I knew that someone had figured this problem out for the wealthy… I just had to find a way to learn what they knew.

Think Like a Billionaire’s Tax Accountant

What do all of the following have in common?

If you guessed that they were billionaires, you’d be right. But what I think about when I see these men is that they all pay a lower percentage of tax on their income than you and me.

When I was out of ideas and tax planning resources, I would often ponder my client’s situation and imagine some wealthy billionaire’s lawyers and accountants working up some recommended law or loophole. These experts would draft everything up and find someone to lobby a congressman to push it through into law. All so they could get out of paying tax and grow and keep their wealth.

These accountants and lawyers would have to create a win-win solution that allows their billionaire bosses to save on taxes while also enabling the congressman to demonstrate how their suggested law benefits the government and the population at large..

*Congresspersons are too busy raising campaign money to read the laws they pass. The laws are written by staff tax nerds who can put pretty much any wording they want in there.”

- Dave Barry, Author & Columnist

I thought about business, real estate, investments, and estate taxes and would imagine what I would do in the same situation. What law would I propose that would align the billionaire’s goals with the governments, or vice versa?

I would then go and search for these ideas in the IRS tax code and through Google searches to see if I could find a tax strategy or law that did what I was thinking. More often than not, I would stumble upon some variation of these ideas and laws and discover tax planning strategies for my clients.

Many years have passed and I have developed a much more comprehensive view of the tax code, but the principles of tax planning remain the same.

👉🏻 If we want to find tax savings, we should seek to understand why the laws have been written the way they have, and how we can align with those laws to gain the associated tax savings.

How Politicians Think about Tax

What is the greatest power that a politician has?

Wage war?

Change laws?

Influence society?

Control and guide the nation toward some ideal state?

I think all of those are strong powers, but there is something greater that both facilitates and empowers these.

The greatest power that a politician has is the ability to tax the population.

Through taxation, the politician has the ability to influence certain activities, to control and guide the people and so the nation, to wage economic war against other countries and to raise money to fight wars. Taxation is a powerful force that exerts pressure at every level of society.

Politicians on both sides of the aisle understand this and seek to wield this power to accomplish their goals. This is the very reason that the tax burden on society has only continued to grow.

The Government’s Goals with Tax Law

The only difference between death and taxes is that death doesn't get worse every time Congress meets.

- Will Rogers, American Humorist & Entertainer

When we see that politicians use the tax law to wield power, we then need to ask how they use that power to accomplish their goals.

Here is the secret:

The government needs the partnership of its citizens to accomplish its goals, utilizing an elaborate system of incentives and penalties known as the tax law and IRS tax code to encourage participation.

This partnership between government and taxpayer is like a dance. The government leads with its laws and incentives, often stepping on toes to begin with, but then getting the rhythm set. Then the taxpayers respond, moving in tune to find ways to maximize wealth and minimize taxes. When both partners move in sync, the dance is smooth and everyone benefits.

The problem is, while the rich get out on the floor and learn the dance, most of us stay seated on the sidelines like insecure, pimple-faced high schoolers afraid of making a mistake or looking stupid.

The rich understand that investing their money in ways that synchronize with the government’s incentives makes them richer by building their wealth and paying less in taxes.

The real question you should ask yourself is how long you’ll stay on the sidelines letting your wealth diminish one tax bill after another?

If you want the incentives (tax savings) and to avoid the penalties (crazy high taxes), you need to know what the government’s goals are and how you can align your personal wealth growth goals with them.

Goals of the Government

What does the Government want? What do Politicians want?

Tax Dollars?

More Money?

Political Control?

Funding for their special programs?

Appease special interest groups, donors, and lobbyists?

Re-election?

Without discounting any of the above, I believe those are all too small of a focus. Beyond all of these superficial issues, there is what I believe the Government and Politicians are really after and held responsible for. Underneath the complex web of laws and tax codes are the following ambitions:

Certainly without a focus on these things, no politician is going to last very long as the population will quickly turn on them and vote them out.

On a more practical level, how does the Government accomplish these goals? They provide for the above through:

Food

Shelter

Protection

Education

Peace

Same Goal, Different Paths

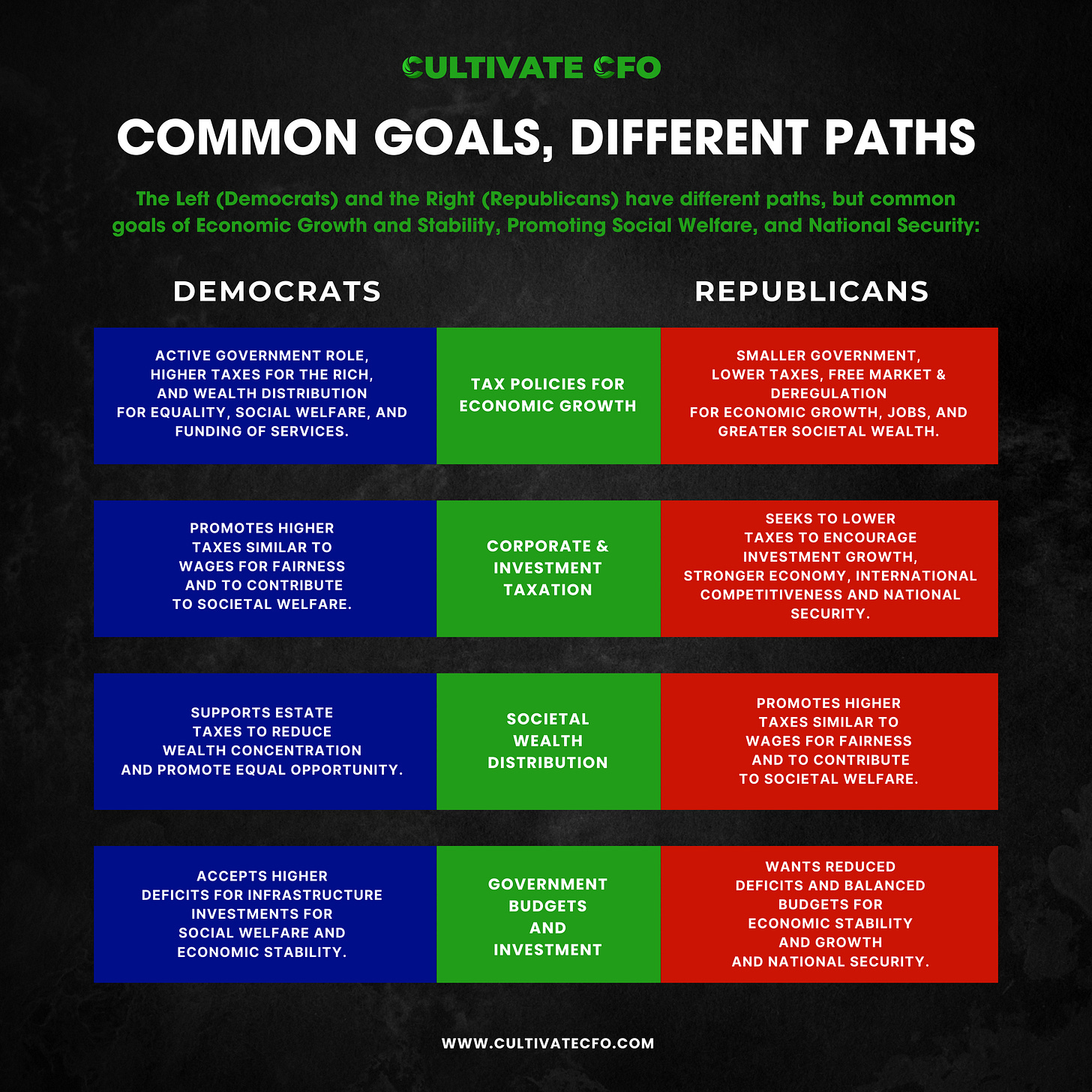

While I’m happy to stay out of the muddy waters of politics, we can’t avoid or ignore the political influence on taxation. The Left (Democrats) and the Right (Republicans) have different approaches, but common goals I discussed above of Economic Growth and Stability, Promoting Social Welfare, and National Security:

Tax Policies for Economic Growth:

Left: Active Government Role, Higher Taxes for the Rich, and Wealth Distribution for Equality, Social Welfare, and Funding of Services.

Right: Smaller Government, Lower Taxes, Free Market, & Deregulation for Economic Growth, Jobs, and Greater Societal Wealth

Corporate & Investment Taxation:

Left: Promotes Higher Taxes Similar to Wages for Fairness and to Contribute to Societal Welfare.

Right: Seeks to Lower Taxes to Encourage Investment Growth, Stronger Economy, International Competitiveness and National Security.

Societal Wealth Distribution:

Left: Supports Estate Taxes to Reduce Wealth Concentration and Promote Equal Opportunity.

Right: Opposes High Estate Taxes to support Family Businesses and Sustained Growth in the Economy.

Government Budgets and Investment:

Left: Accepts Higher Deficits for Infrastructure Investments for Social Welfare and Economic Stability.

Right: Wants Reduced Deficits and Balanced Budgets for Economic Stability and Growth and National Security.

Tax Policies: Joe Biden vs Donald Trump

How does this play out in practical terms? How do the policies of politicians seek to establish economic growth and stability, social welfare, and national security?

We can look at the tax policies of Joe Biden and Donald Trump as examples of how politicians use tax to wield power. There is a stark difference between these two views, as is often the case between Republicans and Democrats, in terms of their goals and what they view as most beneficial for the nation and its citizens. This results in differences in what areas of the tax code are emphasized and what incentives are unlocked.

Donald Trump implemented the 2017 Tax Cuts and Jobs Act (TCJA) which were the most substantial changes to the tax code since the 1980s.

Trump’s focus with his tax initiatives were around stimulating economic growth and securing the nation’s competitive advantage on the world stage.

Some of the key features of the TCJA were:

Cutting the Corporate Income Tax Rate from 35% to 21%. This made US companies more competitive in the global marketplace as the 35% rates were among the highest in the world. Reducing corporate income tax benefits workers as new investments boost productivity and lead to wage and job growth. See more on these benefits in this article: https://taxfoundation.org/research/all/federal/benefits-of-a-corporate-tax-cut/

Move from a worldwide tax system toward a territorial system of corporate taxation. A territorial tax system taxes income based on the country of its source, with exemptions for foreign-earned income and no additional tax on repatriated earnings. At the same time, the TCJA reduced the risk of tax avoidance in lower-taxed regions. This helped repatriate earnings and wealth back to the US. https://taxfoundation.org/taxedu/glossary/territorial-taxation/

Pro-growth tax plan. Through provisions like the Qualified Business Income (QBI) deduction (which allows a 20% deduction for eligible small business owners), 100% Bonus Depreciation (to deduct larger assets fully in the year purchased), and Qualified Opportunity Zones (investment zones with tax benefits), the TCJA sought to stimulate economic growth. The initial analysis indicated that the TCJA “would spur an additional $1 trillion in federal revenues from economic growth.” Over a decade, the TCJA “would increase GDP by an average of 0.29% per year.” This will also lead to “1.5% higher wages, and an additional 339,000 full-time equivalent jobs.” https://taxfoundation.org/research/all/federal/final-tax-cuts-and-jobs-act-details-analysis/ https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-a-comparison-for-businesses

Trade Agreements. Trump removed the US from the Trans Pacific Partnership, renegotiated the North American Free Trade Agreement, and engaged in trade conflicts with China. He attempted to create trade deals that supported American companies and workers.

In contrast, Joe Biden’s proposed tax plan in 2020 sought to make the following changes to the tax code.

Biden’s tax plans were primarily focused expanding healthcare and social programs and funding energy initiatives focused on reducing climate change.

Raising the Corporate Tax Rate from 21% to 28% (attempted but did not pass) as well as a 15% minimum tax on all revenue reported to investors for corporations regardless of tax breaks or loopholes (passed with the Inflation Reduction Act).

Raise Long-Term Capital Gains Tax to Ordinary Income. This would raise the top capital gains rate for those making more than $1M from 20% to 39.6%.

Rejoining Trade Agreements. Biden has sought to rejoin the Trans Pacific Partnership and loosened economic restrictions on China.

Lower Energy Costs. The Inflation Reduction Act would provide credits and tax cuts to invest in green energy, carbon emissions reduction, climate change solutions

Affordable Healthcare Costs. The Inflation Reduction Act lowers prescription drug prices and healthcare costs.

https://www.mhmcpa.com/insights/article/comparing-the-trump-and-biden-tax-plans

Even though these two Presidents focused on different programs and incentives, you can see that both plans still fell within the same general categories discussed above. Though they are going about it differently, they are each still seeking to stimulate economic growth, promote social welfare, and increase national security.

The strategic business owner and investor will keep up with recent tax law changes and discover new ways to align their investments to maximize their savings and grow their wealth.

Paid Subscribers will get the following below:

How the Government seeks Partnership with Businesses and Investors to accomplish their goals

Curated video of Tom Wheelwright explaining the mindset behind tax planning

The 7 Best Investments for Tax Savings

How to Use the Tax Code to Build Wealth

Cultivate CFO is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Questions or further thoughts? Feel free to drop them in the comments and we can dive deeper!