Beneficial Ownership Information - CPA Guide to File Your BOI Report in 5 Simple Steps

Confused or Lost with your BOI Report? 30-Minute Filing by Following these 5 Steps: Due Date, Entity Confirmation, Beneficial Owners, File Report, & Update Report

Disclaimer: My goal in these articles is to simplify the complex and help you take the next step in your financial situation. As such, this is not a comprehensive deep dive into every possible nuance of BOI Reporting. This article, like all my resources, is intended solely for educational purposes and should not substitute for specific investment, financial, or tax advice. Always consult a qualified tax professional for guidance about your situation.

A complete walkthrough of this article is available through the video below:

💡 Key Takeaways - Tl;dr:

Step 1: Determine When Your BOI Report is Due

Startup in 2024: 90 days after formation

Everyone else: 12/31/2024

Step 2: Discover if Your Entity has to Report

Yes: If you filed with the Secretary of State

No: Non Profit, Large Company, Inactive Company, Trust, or Other Exception

Step 3: List Which Individuals Qualify as “Beneficial Owners”

25% or more Control or Ownership

Individuals with Substantial Control

Company Applicant

Step 4: File Your BOI Report

Gather Company & Beneficial Owner Information

Go Online to File

Step 5: Keep your BOI Report Up-to-Date

Business Changes

Beneficial Owner Changes

Why Do I Have To File This???

Every few years, the government seems to find another onerous reporting obligation for business owners to comply with. They usually group this reporting in with tax return filings to simplify compliance and the ease of processing the required information.

However, this year we see a new layer of government reporting under FinCEN, the Financial Crimes Enforcement Agency, that extends to more than 36 million businesses and their innumerable owners and key persons. This new filing requirement is called the Beneficial Ownership Information (BOI) report and it requires each business to report the personal identifying information about a company’s owners and key employees and decision-makers. Basically, they want to know every part of your wealth and control of businesses to make sure you’re doing the right thing… what could be nefarious about that?

Leaving aside my personal feelings about this whole thing, the reality is that it does need to be done if you are going to keep your business open, unless you want to take the government to court.

I’ve had a number of my clients already call and ask about what they need to do. They’ve watched some videos or read some articles, but they are still unsure about what exactly is required and how to go about doing it.

They are right to be proactive on this filing, because the cost of noncompliance for owners and senior officers is up to $500 per day in addition to criminal consequences which may include imprisonment for up to 2 years and/or a fine of up to $10,000. It’s all stick and no carrot on this one.

Here’s the question I want to help you answer:

Is this BOI filing easy enough for a business owner to do themselves; or do they need to hire a lawyer or accountant to take care of it for them?

I’ve promised my clients that I will write this article and put enough resources together that they or anyone can confidently complete this filing requirement.

The purpose of this article is to help you understand what BOI is, who needs to comply, what you need to do, when the deadlines are, and how to complete the filing. I will walk you through step-by-step so that you can complete this filing for each entity you are a beneficial owner of and avoid the penalties of mistakes and noncompliance.

The reporting itself is fairly straightforward, but determining which businesses and which individuals need to be included can be a bit tricky. You need to take the following steps to be compliant with your BOI report:

Step 1: Determine When Your BOI Report is Due

Step 2: Discover if Your Entity has to Report

Step 3: List Which Individuals Qualify as “Beneficial Owners”

Step 4: File Your BOI Report

Step 5: Keep your BOI Report Up-to-Date

Step 1: Determine When Your BOI Report is Due

First things first - you need to know what the timeline is to complete this report so you know whether you need to get on it now or if you have some room to work on this. Keep in mind that if you fail to report your information on time, the penalties are $500… per day… that can add up quickly.

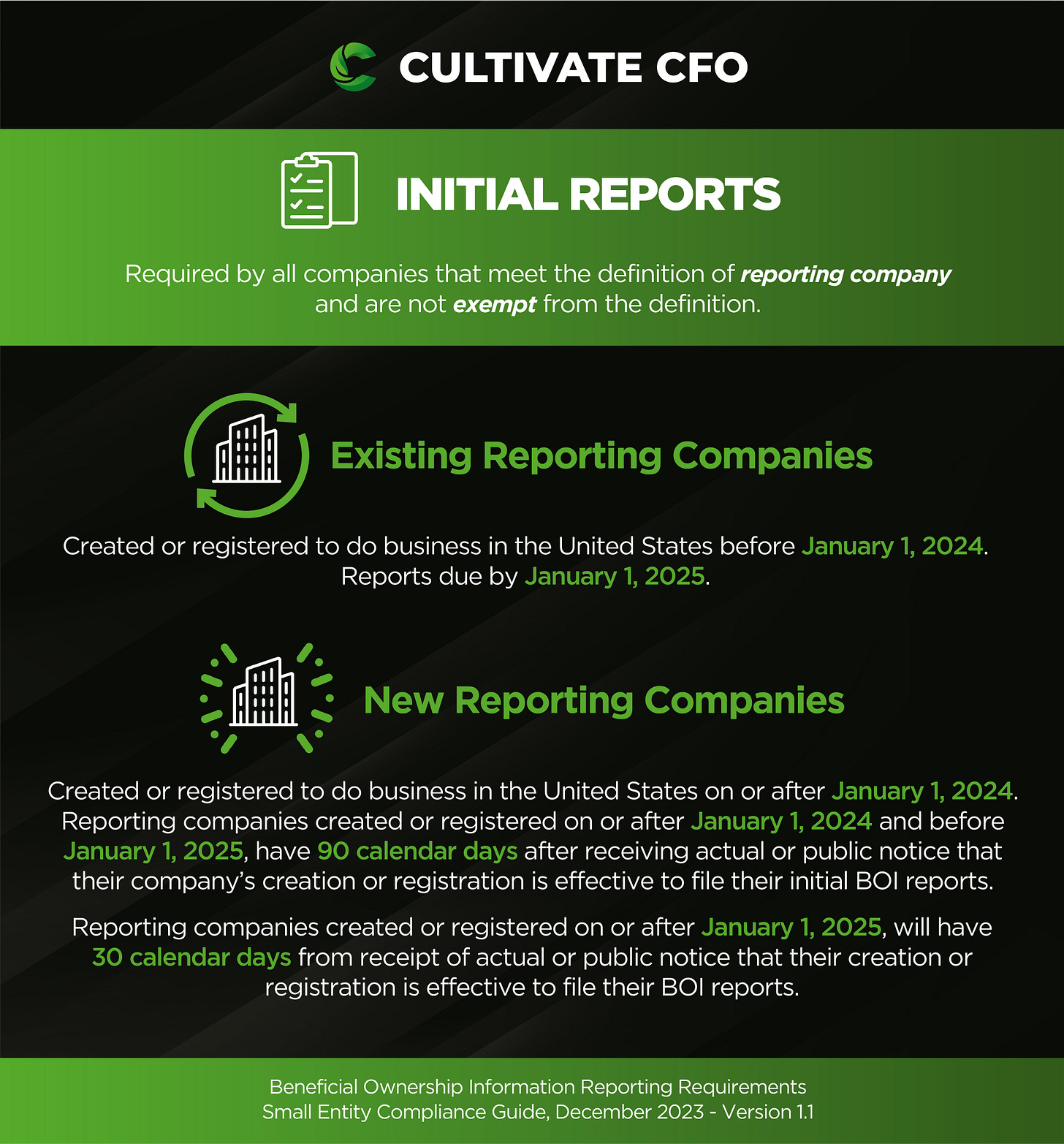

As of the writing of this article, the timeline for completing this report is as follows:

Reporting Entities in existence before December 31, 2023

Filing Deadline: December 31st, 2024

Reporting Entities formed from January 1st, 2024 to December 31st, 2024

Filing Deadline: 90 Days from the initial filing with the Secretary of State

Reporting Entities formed after January 1st, 2025

Filing Deadline: 30 Days from the initial filing with the Secretary of State

Credit: BOI Small Compliance Guide v1.1

Step 2: Discover if Your Entity has to Report

The second step is for you to determine whether your entity has to file a report.

A BOI Report is required for any entity that is created or registered by forming a document with the Secretary of State including (but not limited to):

Limited Liability Company (LLC)

Limited Liability Partnership

Corporation (C & S Corp)

Partnership (Limited & General)

These “reporting entities” are required to file this report unless your entity falls under the following exemptions:

Most Common Exemptions to Filing a BOI Report:

Nonprofit with active nonprofit status

Large operating entities with more than 20 full time employees and more than $5M in gross receipts.

Trusts that meet the requirements in paragraph 1 or 2 of the Internal Revenue Code Section 4947.

Inactive Entities are exempt from reporting if they meet the following requirements:

In existence before 1/1/2020

Has not engaged in any active business

Is not owned by a foreign person

Has not experienced any change in ownership in the last 12 months

Has not sent or received any funds of more than $1,000 in the last 12 months

Does not hold any kind or type of assets in the USA or abroad, including ownership in another entity

Less Common Exceptions

Step 3: List Which Individuals Qualify as “Beneficial Owners”

The next step before you file your BOI report is to make sure you know who your Beneficial Owners are and collect all their relevant information to prepare for your filing. This is the most complex part of this process for most filers, so I will spend a little more time on this section.

Key Tests for Beneficial Ownership:

Ownership

Substantial Control

Beneficial Ownership Exceptions

Company Applicant (not Beneficial Owner, but information required)

Business Owners who are required to be a part of this filing include:

Any individual who owns 25% or more of a reporting entity

Any individual who controls 25% or more of a reporting entity

Ownership or controlling interest is that which is obtained through any of the following:

Equity

Stock

Capital or Profit Interest

Voting Rights

Any instrument, option, non-binding privilege, contract or mechanism convertible into any of the above forms of ownership.

Individuals with Substantial Control who are required to be a part of this filing include:

Senior Officers (i.e. CEO, CFO, COO, CXO)

Members of the Board of Directors

Those who have authority to appoint or remove senior officers and members of the board of directors or governing body

Those who make, direct, or influence the company’s important decisions like reorganizations, mergers and acquisitions, making amendments to the company’s governance documents, adding or removing lines of business, expanding into different markets, determining senior officers’ compensation structures, dissolving the business, entering into contracts, and selling or leasing principal assets, etc.

Those with indirect substantial control including control of intermediary entities that exercise substantial control, financial or business relationships with other entities or individuals acting as nominees.

Examples for How to Determine Beneficial Owners

The following examples are detailed in the BOI Small Company Compliance Guide and provide helpful and practical insights into how to determine who are the beneficial owners. A picture is often worth a thousand words, so hopefully you can find a situation similar to yours in the following examples that will help you know who qualifies as a Beneficial Owner.

Example #1: Single Member LLC

Individual A is the sole owner and president of the company and makes important decisions for the company. No one else owns or controls ownership interests in the company or exercises substantial control over the company.

✅ Individual A is a Beneficial Owner through both exercising substantial control and owning more than 25% of the company’s ownership interests

Example #2: Corporation with Varied Ownership

The company’s total outstanding ownership interests are shares of stock. Three people (Individuals A, B, and C) own 50 percent, 40 percent, and 10 percent of the stock, respectively, and one other person (Individual D) acts as the president, for the company, but does not own any stock.

✅ Individuals A, B, and D are all beneficial owners of the company. Individuals A and B own more than 25% of the company, and Individual D exercises substantial control.

❌ Individual C is not a beneficial owner due to owning less than 25% of the reporting company and not exercising substantial control.

Example #3: LLC With Management and Non-Management Shares

The reporting company is an LLC with two managers, Individuals A and C. Individual A also owns 50 percent of the “membership units” in the LLC while Individual C does not. Individual B owns the remaining membership units in the LLC but is not a manager.

✅ All three individuals are considered beneficial owners in this case. Individual A due to business ownership and substantial control as a manager, Individual B due to business ownership, and Individual C due to substantial control.

Example #4: Complex Ownership Structure

The reporting company is a corporation with multiple indirect owners through Company Y and Company Z. In this example, Individuals A, B, C, and F are beneficial owners. Review the diagram and then see the notes below for a deeper explanation.

✅ Individual A: Yes due to Substantial Control as a CFO. Yes also as an Indirect Owner due to owning 27.5% of the Reporting Company (Company Y 50% x 30% = 15% + Company Z 50% x 25% = 12.5% = 27.5%).

✅ Individual B: Yes as an Indirect Owner of 35% of the Reporting Company (Company Y 50% x 70% = 35%)

✅ Individual C: Yes due to Substantial Control as the Reporting Company’s CEO and President.

❌ Individuals D & E: No due to not owning more than 25% of the Reporting Company or exercising Substantial Control.

✅ Individual F: Yes due to Substantial Control as a member of the Board.

Company Applicant Information

The only other individual besides the beneficial owners whose information is required is the Company Applicant.

This is only for entities created or registered after January 1, 2024

The Company Applicant is the individual who filed or directed or controlled the reporting entity’s formation or registration documents.

Exceptions for Individuals Being Included in this Filing

An employee (not in a senior position) whose control or economic benefits from the reporting company are derived solely from their activities as an employee.

An individual who has only a future ownership interest through a right of inheritance (once they inherit the interest, they must be reported)

A custodian, nominee, intermediary, or agent of another individual who meets the beneficial owner definition

A minor child (information about a parent or guardian must be reported instead)

Creditors of the reporting company

The Information you need to collect for each of the Beneficial Owners and Company Applicant includes:

Full Legal Name

Date of Birth

Residential Street Address

ID Document: Driver’s License, Passport, State ID

FinCEN Identifier (if applicable, helps streamline completion of BOI forms)

Step 4: How to File Your BOI Report

We’ve confirmed our company is a reporting entity, and we’ve got a list of all the Beneficial Owners and the Company Applicant along with their personal information. You’ll also need your entity information below:

Reporting Company Information Required to File BOI Report:

Full Legal Name

Alternate Name: DBAs or trade names used to conduct business

Principal U.S. Business Address

Formation jurisdiction information (state, tribal, or foreign)

EIN (Employer Identification Number) or SSN/TIN (Social Security Number/IRS Taxpayer Identification Number)

FinCEN Identifier (if applicable)

Now it is time to go online to file your report. Here is the link: https://boiefiling.fincen.gov/fileboir

This can be done one of two ways, either by:

Preparing a pdf which you will later upload once complete.

Or filing directly on the FinCEN website

The process is similar either option you choose, but the pdf allows you more time if you don’t have all of your information, and can be helpful as a record. It also saves time if you have updates as you will only have to make the specific changes and will be able to re-upload the completed report as opposed to completing the whole process from scratch online. As I believe this will be the best option for most people, I will be reviewing how to complete the PDF report in the pictures below:

BOI Report Page 1 - Filing Information

This is likely your initial report, so you will only be selecting box 1a on this page. If you are correcting or updating, you will complete the rest of this information

BOI Report Page 2 - Reporting Company

The second page is for the reporting company information.

You may want to select to receive a FinCEN Identifier for this entity (line 3) if the entity holds ownership interest in other companies. This will enable you to provide the FinCEN ID of your company for the reporting of the other companies instead of each of the beneficial owners’ information each time. This simplifies the process and prevents your personal information from being passed around more than necessary.

BOI Report Page 3 - Company Applicant

Most of you are going to be preparing an initial filing if your company was in existence before January 1, 2024. If so, select the checkbox on line 16 and move on to the final page.

If you began your business after January 1st, 2024, you will need to complete this page with your Company Applicant information.

The Company Applicant is the individual who filed the formation documents with the Secretary of State. You may report up to 2 Company Applicants.

As with the Entity FinCEN ID above, an individual can also obtain a FinCEN ID, though not in the BOI Report. This both simplifies reporting and provides greater security for your personal information. You can obtain a FinCEN ID here: https://fincenid.fincen.gov/landing

BOI Report Page 4 - Beneficial Owners

The final page is where you enter information for each of the Beneficial Owners. Keep in mind that Beneficial Owners can also apply for a FinCEN ID as discussed above, which is preferable if you own multiple entities and would like to simplify this process.

You’ll need a Drivers License, State ID, or Passport available to upload a JPG, PNG, or PDF file 5 MB or less with your report.

Upload Completed BOI Report File

Once you’ve completed your file and attached the relevant documents, return back to page 1 and go through each of the steps to Validate, Finalize, and Save your report.

You can then select “Ready to File” to return back to the BOI Report E-File site to submit your report.

You’ll receive a submission confirmation of your successful filing. You’ll want to print the screen or download the transcript as confirmation of your filing.

Step 5: Keep your BOI Report Up-to-Date

Do you have to file a BOI report every year? No - but you do have to keep your BOI information up-to-date with any changes to the reporting entity or beneficial owners.

FinCEN requires reporting companies to file an updated report within 30 calendar days of when a relevant change occurs or when they realize they provided inaccurate information on the BOI report.

You will file an updated report to:

Correct a prior report

Update a prior report

Indicate a classification change to an exempt entity

Examples include:

Registering for a new trade name

Change in Beneficial Owners like a new CEO or change of ownership beyond 25%

Changes to the Beneficial Owner’s information including new IDs, change of address, or change of name

You won’t have to repeat this filing unless you have any of these changes, but you do need to be ready to make these changes timely to avoid penalties for late filing.

If you obtained a FinCEN ID and your change of address or personal information triggers an update for your company, you also need to update your FinCEN ID information, which you can do here: https://fincenid.fincen.gov/landing

Additional Resources

The information in this article will likely be sufficient for most business owners to be able to complete their own reporting entity filings; however, if your situation is complex or you are looking for answers to your questions, I have provided additional links to resources below for you to review:

BOI Frequently Asked Questions - hundreds of questions and answers about most every situation

BOI Reference Materials - the most up-to-date information, regulations, and rules

Beneficial Ownership Information Reporting Online - Links to PDF and Online Filing Options

As mentioned above, a complete walkthrough of this article and the BOI reporting process is also available through the video below:

Cultivate CFO is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Questions or further thoughts? Feel free to drop them in the comments and we can dive deeper!

If you would like help filing this report, please schedule a meeting with our team to help you complete this filing.

Hi Mark,

Let me begin by saying this is a very good article. I appreciate how you have simplified the information into easy steps for business owners and readers to digest and follow to complete their BOI report. To be honest, I was not aware of this filing requirement by FinCEN until reading your article. So naturally, I had to learn more… The more I read, the more I began to question the constitutionality of the CTA’s reporting requirement.

It should be noted that I am coming at this from a legal perspective and not necessarily a tax perspective. I began by looking into the case law on this issue and found that several lawsuits have been filed, including one by the National Small Business United, dba the National Small Business Association, and another by the Small Business Association of Michigan. To date, the U.S. District Court for the Northern District of Alabama, Northeastern Division, has granted summary judgment to the National Small Business United, declaring that “[The CTA] is unconstitutional because it cannot be justified as an exercise of the Congress’ enumerated powers.”

The court's decision in NSBA v. Yellen was based on the principle that Congress must act within the limits of its enumerated powers under the Constitution. Historically, states have had the authority to regulate businesses, including the formation and governance of corporations, LLCs, and other entities. This state-centric approach to business regulation is rooted in the Constitution’s allocation of powers, where any authority not explicitly granted to the federal government is reserved for the states.

The court found that the CTA did not fall under the Commerce Clause, the Necessary and Proper Clause, or Congress' powers related to foreign affairs and national security. Specifically, the CTA's requirement for entities to disclose personal information of beneficial owners was deemed to exceed the scope of Congress' authority, as it regulates internal state affairs, which are traditionally under state jurisdiction. The ruling emphasized that the CTA lacked a sufficient nexus to any enumerated power, making it an overreach of legislative authority.

The court held that the CTA failed on all constitutional arguments presented. It could not be justified under the Commerce Clause because the act of incorporating a business is not itself an economic activity that substantially affects interstate commerce. The Necessary and Proper Clause did not support the CTA because the law was not an essential part of a broader regulatory scheme and was not closely tied to any of Congress' enumerated powers. Lastly, the arguments for the CTA under Congress' powers related to foreign affairs and national security were found insufficient, as the regulation of state-incorporated entities remains primarily a state concern.

As a result, this decision enjoined the enforcement of the CTA against the plaintiffs and NSBA members, but FinCEN has maintained that other entities must still comply with the reporting requirements. The Justice Department has appealed the decision, and the case is now pending before the Eleventh Circuit Court of Appeals. The outcome of this appeal will be critical in determining the future of the CTA and its application to businesses nationwide, but FinCEN has been clear that they intend to continue to enforce the BOI reporting requirements while their case is pending before the Eleventh Circuit Court of Appeals.

Nonetheless, it is important for business owners, officers, and anyone who falls under this reporting requirement to ensure that they are following the reporting information that you have provided so that they do not find themselves subject to criminal penalties. It will be interesting to see how the appellate courts address these issues.

Case Cited: Nat'l Small Bus. United v. Yellen, No. 5:22-cv-1448-LCB, 2024 U.S. Dist. LEXIS 36205 (N.D. Ala. Mar. 1, 2024)

Thank you, Mark. What video editing software do you use?