Tax Planning vs Tax Preparation: Why Your Accountant is Costing You Money

Business Owners often pay a high price in taxes before they learn that their Tax Preparation Fee doesn't include Tax Planning and won't change their Tax Bill.

💡 Key Takeaways, TL;DR:

Tax Preparation is not Tax Planning

Most Tax Accountants have never learned, and don’t perform Tax Planning

Tax Planning is the process of evaluating your current income, assets, and life situation along with your wealth building goals, future income, retirement, and estate plans, to prepare a strategic plan that will accelerate wealth creation and result in the lowest tax liability.

Your most expensive bill at tax time is your tax bill, not your advisor’s fees.

Good tax planning won’t get you audited.

Tax evasion is illegal, but tax avoidance is encouraged.

Disclaimer: My goal in these articles is to simplify the complex and help you take the next step in your financial situation. As such, this is not a comprehensive deep dive into every possible nuance or strategy. This article, as with all my resources, are for educational purposes only, and are not to be used as specific investment, financial, or tax advice. Always consult a qualified tax professional for guidance about your tax situation.

This article is the first in our Tax Planning Series where I seek to educate Business Owners and Investors on how to develop an effective Tax Planning Strategy to support their Wealth-Building Goals.

I am writing this article for business owners and investors who are frustrated with the amount of tax they owe (or will owe) and want to know what they can do about it.

It is for those who are seeking to build their wealth and grow a business, but hate being set back by the big IRS check that goes out the door every year.

This article is for those who have been working with a CPA or Tax Accountant, but aren’t seeing their work make a big difference in their tax bill.

In this article, I’m going to help you understand:

What Tax Planning is, and why it’s important

Why Tax Planning is different from Tax Preparation, and

Why you need to engage in Tax Planning if you want to Build your Business and Grow your Wealth.

Paid subscribers will also get access to:

5 Steps to Lower Your Tax Liability

Confusion Around Tax Planning vs Tax Preparation

First Big Misunderstanding: Your Tax Preparer is both preparing your tax returns and saving you money on your taxes with Tax Planning.

“I paid a CPA to do my taxes. Didn’t they make sure I owed the lowest tax liability?”

Many business owners have the impression that if they advance beyond TurboTax or H&R Block and hire a tax accountant or a CPA that they will be getting better tax advising that will help them save money on taxes, but this is rarely the case.

Second Big Misunderstanding: People mistake Tax Planning for Planning to Pay their Tax Liability.

“I’ve done tax planning - my accountant helps me plan my estimated tax payments.”

🤦🏻 So wrong…

I’ve written this article to clarify the differences between tax planning and tax preparation and to show you how powerful good tax planning can be in achieving your financial and wealth creation goals.

Why Doesn’t My Tax Accountant do Tax Planning?

1. Education

The reason that you don’t get tax planning when you go to a tax accountant or CPA is simply because the education they receive is focused on tax compliance, not tax planning. Tax compliance is the first step for an accountant entering into the field, and is pretty easy to understand, even if it takes a while to learn all the details of the tax code.

2. Traditional Focus

Most tax firms focus on tax preparation and IRS compliance - that’s all. Tax preparation workload for most firms is high so that they can make a decent profit. But this also means that they aren’t incentivized to go deeper than simply preparing the return to help you save on taxes.

3. Right Brain vs Left Brain

When you think of your tax accountant, which of the following comes to mind?

Left Brain: Logic, Analytical Thinking, Math, Sense of Time

Right Brain: Creativity, Intuition, Imagination, Holistic Thinking

Tax Preparation relies heavily on logic, analytical thinking, and math skills.

Tax Planning relies on divergent thinking, creativity, imagination, and creating a variety of potential futures for strategic wealth planning.

A lot of accountants I know struggle to transition their mindset from compliance to creative to really succeed in tax planning for their clients.

This was my experience for the first half of my career as a CPA - my Masters in Accounting and Financial Management and all the professional training and work focus was all on tax compliance. I had to take the initiative to dig deep and learn tax strategies and planning options for my clients.

Don’t get me wrong!

I don’t mean to take away from the significant value of accurate tax preparation and compliance work. The reality is that it is quite challenging work that takes a robust knowledge of the tax code. Filing your returns accurately is important and keeps you out of audit trouble with the IRS.

But apart from keeping you out of an audit, getting correct tax returns filed doesn’t actually bring much value to you as the taxpayer because you are still on the hook for the bill!

Just because you have a compliant and correct tax return that will pass an audit, doesn’t mean you are paying the least amount of tax you legally owe.

The reality is, the vast majority of business owners overpay in taxes while filing “correct” tax returns. We see this often with business owners coming to us that they are often overpaying by 20%-50% or more on their taxes.

“You must pay taxes. But there's no law that says you gotta leave a tip.”

Morgan Stanley

What is Tax Planning?

Tax Planning and Tax Preparation are very different activities requiring different mindsets and skillsets with different end goals.

A Tax Advisor is less focused on the left-brain compliance focus of getting everything neatly fitting in the right boxes, that comes later. Rather, the Tax Advisor is focused on the right-brain, creative activity of discovering new opportunities, repositioning facts and circumstances, finding areas of alignment between wealth creation and the tax incentives, and creating solutions.

Instead of starting with the end result of the tax preparation where you might owe $175,000 and thinking about reducing that number, the Tax Advisor begins at $0 and deliberately adds back only the taxable income and liability that increases wealth only after all other strategies have been exhausted.

Tax Planning Definition

Tax Planning is the process of:

Evaluating your current income, assets, and life situation,

Along with your wealth building goals, future income, retirement, and estate plans,

To prepare a strategic plan that will

Accelerate wealth creation and

Result in the lowest tax liability.

Tax planning begins with the realization that the tax law and IRS Code is written with less than 0.5% focused on what income is taxable, and 99.5% on ways to reduce your tax liability. The tax code is mostly written as a series of incentives for business owners and investors to reduce their tax liability. In other words, the government wants you to do certain things with your money and will incentivize you or penalize you depending on what you do with your money.

This leads to the second focus: everything you do with your money either increases or decreases your tax liability.

Do you want to invest your earnings into growing your business? Buying or developing real estate? Investing in energy? Then the government will reward you by lowering your taxes.

Do you want to save your money in the bank? Do you want to spend your money on toys and boats and entertainment? The government will penalize you by making you pay more taxes.

When we engage with business owners on tax planning, we focus first on how they are building wealth and what their goals are. We then focus on arranging and positioning the facts and circumstances of their life, income, business, and investments in a way that aligns both with their wealth-building goals and with the tax savings we can unlock

Ultimately, tax planning is about ensuring that you don’t pay more taxes than you legally owe. It is your money, not the government’s. You earned it and you have the right to keep it.

Tax Planning vs Tax Preparation

“Many people believe that where taxes are concerned, they are victims, held hostage by an inevitable process that allows them no input, no control. This passive approach becomes something of a self-fulfilling prophecy; where people believe that they lack control, they seldom try to assert control.”

Richard Carlson

Engaging in tax planning is about becoming an active participant with the government rather than a passive spectator.

While many of the tax laws we have today began taxing those with the ability to pay (the rich), the rich adapted, challenged and fought back to maintain their wealth. Over time, the taxes crept up on the lower and middle classes who had fewer resources and less expertise to fight back effectively. What we have now is the taxation of the passive majority who complain and grumble but ultimately cower in fear and pay the money.

What is Your Most Expensive Bill?

I’d like to put Tax Planning into another perspective for you by asking you this question:

What is your most expensive bill at tax time?

Your Tax Accountant’s Bill

Your IRS Tax Liability Bill

Here is where most people get it wrong:

❌ Most people haggle over their tax preparation bill and yet pay their IRS tax bill without question.

✅ What they should focus on is challenging and lowering the IRS tax bill by investing good money on the best Tax Advisors and Tax Planning.

We see this all the time. People call us up and ask for our tax preparation fee and tell us that H&R Block or another tax preparation firm in our area charges less than we do. We don’t argue that our fees are higher, but I ask them how much their tax liability was. Here is a common example:

Tax Prep Fee: $2,000

Tax Liability: $125,000

Total: $127,000

Now if they had done some tax planning and tax preparation with us, they would have a higher fee, but that is dwarfed by the savings:

Tax Planning, Implementation, and Tax Prep Fees: $13,500

Tax Liability: $75,000

Total: $88,500

That’s a difference of $38,500 in real money out the door! Sure, this is an example, and your situation is undoubtedly different, but this isn’t an unusual situation.

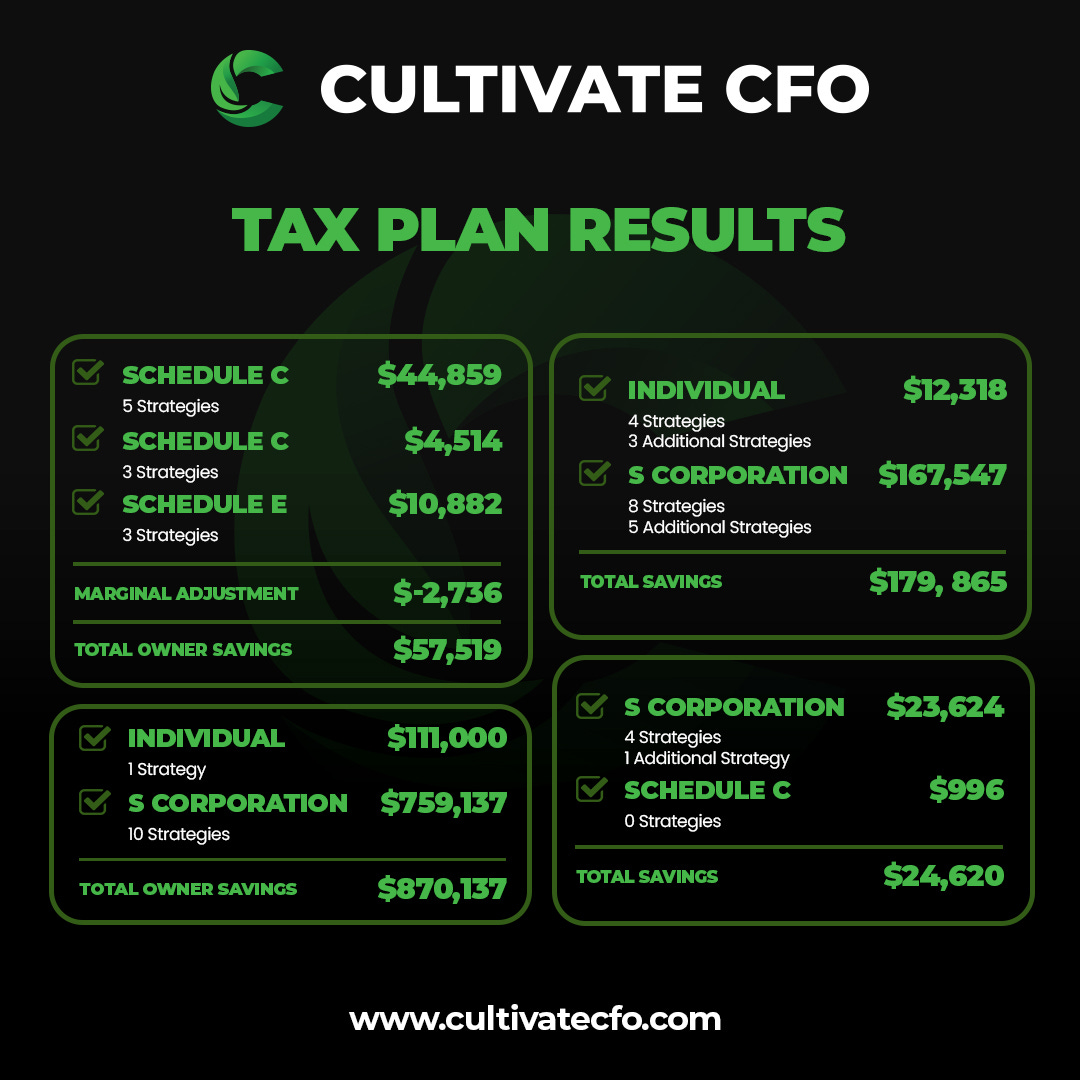

Here are some real-life numbers of tax savings that we have delivered for clients:

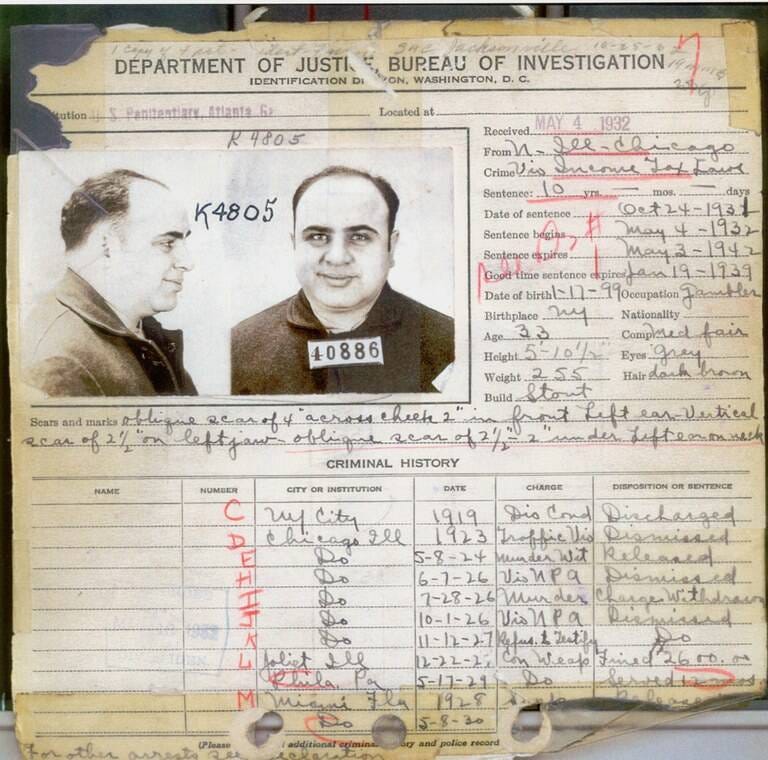

Will Tax Planning Get Me Audited like Al Capone?

After I explain tax planning to a business owner and they are ready to move forward, a common question I get in response is, “What if I get audited?”

This question is based on the false assumption that somehow tax planning is against the law and if you get caught, you’ll get in trouble.

Many people misunderstand tax planning as finding a backdoor loophole that, if found out, will land them in hot water with the IRS. They have some fanciful idea that they are going to end up like Al Capone and get in trouble with the IRS for tax evasion.

“They can’t collect legal taxes from illegal money.” - Al Capone

Unfortunately, that approach didn’t fly for him in court. If only Al Capone had an accountant who did good tax planning!

“[g]ains from illicit traffic in liquor are subject to the income tax would be taxable.” U.S. v. Sullivan, 1927

I’ve curated a fun video where I share that Al Capone was actually a great tax strategist - what caught him wasn’t his tax planning, but his illegal operations and tax evasion.

Fun history aside, high-profile cases like Al Capone’s have given rise to confusion and unwarranted assumptions about tax planning strategies. The reality is that this assumption that tax plans are illegal and will get you into trouble is based on a false understanding about the difference between tax avoidance and tax evasion.

Tax Avoidance vs Tax Evasion

What many people don’t understand is that the main difference between tax avoidance and tax evasion (for those of us who aren’t criminally-inclined like Al Capone here) is simply a matter of timing, framing, and intent.

❌ Tax evasion is breaking the law to reduce your tax liability and typically involves failing to report taxable income or reclassifying or reducing income through reporting false deductions that didn’t actually occur.

✅ Tax avoidance on the other hand is a legal and appropriate arranging of the financial facts and circumstances in order to minimize tax liability within the law.

If you plan ahead and arrange your life and business and finances to reduce your tax liability, you are practicing tax avoidance. If you come in after the fact and make up facts and circumstances and intent that didn’t actually take place, you are entering into tax evasion.

The established legal precedent that both expects and encourages tax avoidance through good tax planning comes from the Federal Appellate Judge Learned Hand in the following two cases.

Appellate Judge Learned Hand is famous for the following quotes from his court decisions:

“Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one's taxes.”

Helvering v Gregory 1934

“Over and over again courts have said that there is nothing sinister in so arranging one's affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant.”

Commissioner v Newman 1947

How to Get Started with Tax Planning

This article is in a series of articles that are focused on educating you, the business owner and investor, in building and protecting your wealth through tax planning. I can’t fit everything you need to know about tax planning in one article, but here is a list of the other articles in this series:

👉🏻 What the Government Really Wants from You

👉🏻 The Big Picture of Tax Planning Strategy

👉🏻 Tax Planning Secrets of the Ultra-Rich

👉🏻 Advanced Tax Planning Strategies

👉🏻 How to Choose a Tax Advisor

But before you jump into those other articles, I want to close out this article with some clear next steps for paid subscribers on how to get started with tax planning.

Paid subscribers will also get access to:

5 Steps to Lower Your Tax Liability

Did you like this article? Please share so that others can learn how to be more strategic with managing their tax liability.

Questions or further thoughts? I’d love your feedback in the comments.

- What was your favorite part of the newsletter?

- What strategies are you looking to implement for yourself?

- What would you love to learn more about?

Feel free to drop them in the comments and we can dive deeper!